Do you know everything you need to know about Robinhood day trading? Whether you’re a finance pro or never heard about day-trading, Robinhood should have met your attention in the past. Before the internet and mobile phones, people could only trade through the medium of well-known financial trading institutions and brokerages. However, along with the swift shift in technology and boom in the online world, online trading has witnessed a rise. Essentially, online trading is significantly easier today to not only have a full grasp on but incredibly uncomplicated to get on as well.

While day trading can be a highly beneficial career for many, it may prove detrimental for the rookies if they do not do it efficiently, backed by well-structured and innovative strategies.

Hence, it is crucial to know your opening moves before throwing in the dice and face rough consequences.

Everything You Need To Know About Robinhood Day Trading

What Is Day Trading?

Day trading typically refers to the practice of trades that you do within a single trading day. Although traders can do it in almost any market, you usually see it being prevalent in exchange and stock markets.

Primarily, day traders are well-trained and know how to implement effective short-lived strategies.

Whether it is about understanding market psychology, updated plans, or shifts in the interest rates and other economic figures, day traders keep a hawk’s eye on everything.

What is Robinhood Daytrading?

Now that we have highlighted day trading. Let’s move to the focal point of this article. Yes, Robinhood day trading!

You might have heard about it, but do you know anything in actuality? Do not worry. In this article, I will uncover. So, without further ado, let’s get started!

What Is Robinhood?

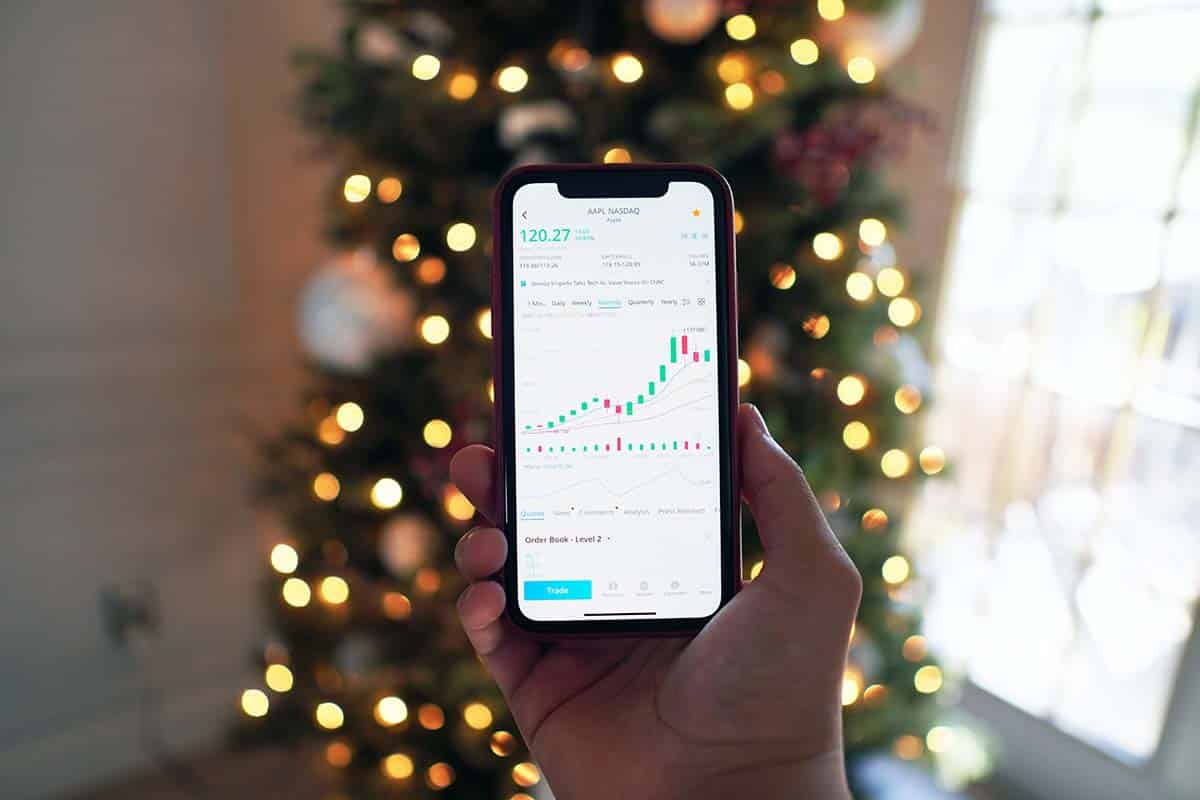

Robinhood is one of the first and largest brokers to offer commission-free trading. Besides being a no commission broker, they created an incredibly user-friendly mobile app. So, the traders stay updated with the changes in stocks and their rates. Robinhood ensures that trading and business keep traders entertained as their essential goals lie in the motto of ‘gamifying’ the industry.

What can I do with Robinhood Day Trading?

As mentioned earlier in the article, day trading is when traders sell and buy the same security within one day. So for instance, If you buy Amazon stocks in the morning and sell it by noon or even the same evening, you have made a day trade.

Correspondingly, Robinhood day trading got popular for cryptocurrency trading, the latest stocks ETFs and other options.

Robinhood day trading is well-known in the trading world because they are one of its kind that does not take commissions.

If you did not know, the commissions are the indirect payment you make to the broker for purchasing stocks or sales and vice versa.

How Does An Online Broker Make Money?

The primary source of income for the brokers is the profit or interest collected from the money lent. Furthermore, the commission fee varies for each broke. Essentially, it ranges from $3.99 to $20 and so on. However, this particular amount changes depending on the different brokers, such as TradeZero or Lightspeed.

What Does Robinhood Offer?

Robinhood is one of the most well-regulated trading brokerages of our modern times. After gaining major attraction from the masses, Robinhood has caused a stir up in the hearts of the enthusiasts of online day trading. Additionally, they not only offer stocks but work with ETFs and cryptocurrency trading as well. Robinhood has worked hard in every department to attain massive success, from brilliant offerings to smooth sailing applications and efficient customer service. Robinhood is one of the very few stock-free trading apps that offer incredible features. These elements can stay updated with the latest stocks, locating different options, and organizing the sectors, respectively.

How Does Robinhood Work?

How To Sign Up For Robinhood?

- Operationally, day trading with Robinhood works in the same way as usual investing does. Similarly, you invest in the stock and proceed to sell it on the same day. You will need to follow the steps mentioned below. Sign up for Robinhood. Fill in your info and get started, as you do not need any minimum deposit amount, to begin with, them.

- Once you have created your account, you can choose the web platform or the Robinhood mobile app. Although most users select the mobile application, both platforms are just as great and user-friendly.

- After submitting the account info, your profile will get reviewed.

- Finally, if your profile gets accepted successfully, you are up to earn your coin without any problem.

What Are The Different Rules Of Day Trading With The Robinhood?

If you want to get into day trading, you will need to get acquainted with few rules beforehand.

Pattern Day Trader Rule:

The PDT rule is one of the very first rules you need to know when it comes to day trading with Robinhood. According to the Pattern Day Trader (PDT) rule, traders who have less than $25,000 in their trading accounts can’t make trades more than three days during the timeline of five days. Additionally, if you make three trades on Monday, you cannot make a day trade until the next Monday.

Different Order Types

Being a Robinhood day trader, you need to be aware of the varying order types.

Default Order Type

The default order type is the type of order in which you can buy whatever shares are available at the moment.

The Limit Order Type

The limit order is one of the most well-known order types as it means that you can invest in the stocks of your own choice with the amount you have available. For instance, you want specific shares at a $X price under such conditions. However, this puts you under some restraints and limitations.

Can You Make Money On Robinhood?

Yes, you can assuredly make money on Robinhood as long as you have experience and training or beginner know-how of the app. You can start making money with the initial amount as small as $100 and step up gradually as you go. Being a commission-free trading application, Robinhood allows you to make profits without worrying about the hidden fees that often get swept under the rug.

Is Robinhood Beginner-Friendly?

If you are a beginner looking into the undiscovered world of investing, Robinhood calls your name. With no commission fees and brilliant policies, you can climb your way up in no time!

Why Is My Robinhood Account Restricted?

On the Robinhood Website, there are the following reasons why your Robinhoof Account is restricted. Robinhood restrictions:

- It is forbidden to trade the stocks from the company you are working.

- Transfer Reversals

- Incorrect or Outdated Information, so keep your data up to date

- Fraud Inquiries

- Account Levies

If your Robinhood Financial account is blocked, your Crypto Account will be blocked for the restriction time, too. To remove a restriction, contact the Robinhood support.

How To Transfer Money From Robinhood To Bank?

The ability to transfer money from an online financial platform to a bank account allows you to carry out various transactions from your bank account. Most service providers are trusted payment banks, so you can move money to such accounts if you have cash in your Robinhood account. For example, the Cash app charges 1.5% for the instant transfer of funds to a bank account, but the standard method is free for 1-3 business days.

All you have to do is enter the amount you want to deposit into the confirmed bank account, and it will show you the correct account to which you wish to transfer the money. You can also add a different bank to the one you deposited the money with and provide additional information. Finally, you must specify the amount withdrawn from the bank account in order to withdraw money. If your Robinhood account has restrictions that prevent you from cashing out, you can contact Customer Service to help. You can withdraw money with iOS, Android, or desktop Wise is an excellent alternative to bank accounts to manage the money you withdraw from Robinhood.

The Bottom Line

The online brokers made access to The Wall Street stock market easy for everyone with their user-friendly trading software. Like the Gamestop short-squeeze or the Bitcoin boom, these events helped them even gain more popularity. So Robinhood took the chance and offered the right tool at the right time. Their mobile app delivered a very easy-to-understand entry in a giant tub of sharks.