Forex is also known as the exchange of foreign currency or FX trading. With an average of $5trillion traded every day, Forex happens to be one of the world’s most actively traded financial instruments. Most of us would have heard about the foreign exchange market, but few people know what it is. Many people wonder how currency trading (often shortened to forex trading) works without learning how to trade currencies themselves. Most of the questions are essentially about what exactly “Forex trading” is and how to make money.

What Is Forex?

Although it is simple, currency trading is similar to foreign exchange. The exchange you might use on trips abroad. But there are different ways to process it. It works by buying one currency and selling another, and the exchange rate constantly fluctuates based on supply and demand. The trader buys one of the currencies and sells the other (usually the US dollar or another foreign currency). Both transactions happen simultaneously. This process works because of two main factors: currency supply, demand for currency, and exchange rates.

What Is Forex Trading?

Foreign exchange trading is the process of buying and selling currency pairs. People speculate on the rise or fall of the price of these pairs. Forex trading always involves buying one currency and selling another. This circumstance is why we put the pair on the stock exchange. It works in the same way as trading other assets. But if you sell in foreign exchange, the cost of trading is relatively low. It is convenient to trade Forex (FX) because its trading day lasts 24 hours (exempt from trading weekends).

The most significant advantage of forex trading is that traders can bet on any currency without any purchase or sale restrictions. It is easy to switch a currency from long to short. And you can buy and sell at a low price at any time, just like with other assets.

Forex trading or Forex exchange is a platform where traders exchange currency between one another at a given price. It is an avenue used by people, industries, and central banks to exchange one currency for another.

Many people venture into Forex trading with the sole purpose of earning a profit. The number of currencies exchanged daily affects some currencies’ trends, thereby making them highly volatile.

Simply put, it is the process of speculation on the exchange rate movement. It happens when people buy one currency, and other people sell simultaneously.

How do Forex traders make money?

For retail traders, you can make money buying and selling currency pairs. And for Forex brokers, traders get access to platforms where they can make Forex trading transactions. You can access these markets through various platforms, such as exchanges, brokerages, trading rooms, and exchanges. Traders can also make forex transactions directly between themselves or through their brokers or dealer partners.

How Much Money Do Forex Traders Make A Day?

A Forex day trader Cory Mitchell said in an article that is, on average, you start with a capital of $30,000 and place about 100 trades per month (which is roughly about five trades per day/20 days per month), you could have around $3,750 profit.

Even so, with a reasonable score rate and risk/reward ratio, a dutiful forex day trader with an adequate scheme can earn between 5% and 15% per month thanks to leverage. Remember that you don’t require significant equity to get started; $500 to $1,000 is adequate.

Forex day trading has no legal minimum, which means $500 is a good start. Regardless, if you intend to generate a decent monthly earning, it’s advisable, to begin with, $5,000.

How Much Money Gets Traded On The Forex Market In A Day?

Roughly about $5 trillion worth of forex trades occurs on a day-to-day basis, which is an average of $220 billion per hour. The market consists of unions, companies, administrations, and currency predictors – prediction consists of about 90% of the trading fraction. A vast majority of this is focused mainly on the euro, yen, and US dollar.

How Much Is Required To Start A Forex Trading?

Starting Forex trade is very easy, unlike that of the stock markets. The forex market is one of the financial markets that are made easily accessible to traders. You can open a Forex trading account with just $50 or even $0. It all depends on the initial minimum deposit required by the Forex broker in use.

How Does Forex Work?

Forex trading takes place directly between two individuals. Contrary to shares and commodities, it doesn’t happen on exchanges but in an over-the-counter market. A universal bank system operates the Forex market, dispersed across four primary Forex trading areas in various time zones: New York, Tokyo, Sydney, and London. You can trade Forex 24 hours a day because it has no central location.

The Three Different Forms Of The Forex Market

1. Spot Forex Market

The Spot forex market involves the physical trade of a currency pair. This type of trade happens at the immediate point when people finalize the transaction.

2. Forward Forex Market

The forward forex market involves signing a contract, agreeing to buy or sell a particular currency amount at a given rate. The agreement will finalize at a given date in the future.

3. Future Forex Market

The future forex market is similar to the forward forex market. The difference is Future Forex market contract is legally binding.

Most traders who specialize in predicting Forex prices often prefer to take advantage of the market price trends rather than take delivery of the currency itself.

What Is A Base And Quote Currency?

A base currency refers to the initial currency recorded in a Forex pair, while the next currency listed is the quote currency. Forex trading involves selling one currency to purchase another, which is why people led it in pairs.

What Moves The Forex Market?

The Forex market consists of different currencies from various countries, making the prediction of exchange rate a tad bit difficult due to the numerous factors that affect the price trends. Regardless, just like several other financial institutions, Forex is mainly steered by supply and demand pressures. It is crucial to amass a vast knowledge of the factors that influences price fluctuations.

Central Banks

The central bank of a country regulates the supply. They can disclose regulations that will have a substantial effect on their currency’s price. For example, inoculating more money into an economy can result in a drop in the currency’s price.

News Reports

Most investors and traders prefer to put their capital into economies with a strong foothold in the finance department. So they’re always on the lookout for positive news, which would suggest an increase in a particular region’s currency. And also, negative information can propel the decrease in investment and devalue the currency’s price. This process is the reason why currencies reflect the financial condition of the region they represent.

Market Sentiment

Market sentiment plays a significant role in influencing currency prices, and it is often in reaction to the news dispersed. If investors perceive that a currency trend is moving in a particular direction, they will follow suit and encourage others to trade accordingly.

Economic Data

Economic data is essential to the price trends of currencies for two purposes – it provides a clue of how an economy is doing, and it gives an idea of what its central bank might execute next.

For instance, let’s say that inflation in the eurozone has increased above the 2% point, and the European Central Bank (ECB) intends to sustain it. The ECB’s primary strategy method to thwart increasing inflation is by boosting European profit rates – so retailers might begin to purchase the euro in expectation of prices scaling. With more investors craving euros, there could be a rise in price for EUR/USD.

Credit Ratings

Traders will attempt to increase their profit from a market while cutting down on their risk. Coupled with profit rates and financial data, they might also glance at credit points when determining where to invest.

A country’s credit grade is a sovereign review of its probability of paying back its deficits. People perceive a region with a high credit rating as a safer region for investment than one with a meager credit rating. This circumstance often shows up when credit ratings are high or low. A country with a boosted credit rating can see its currency rise in price and vice versa.

How Does Forex Trading Work?

There are various ways of trading Forex, but they all have the same function. This task is buying one currency and at the same time selling another currency. Commonly, Forex brokers perform most of the Forex trading.

What Is The Spread In Forex Trading?

The variation between the buy and sell prices cited for a currency pair defines the spread. When traders open a forex position, there are two different prices. This process is the same as in other financial markets. One, for the long positions, the other for the short position. Now, for traders who want to go long they will have to trade at the buy price, which is barely above the market price. For traders who open a short position, they will have to trade at the selling price, which is slightly below the market price.

What Is A Lot In Forex?

In Forex, you trade currencies in lots. Those are stacks of currency used to systematics forex trades. The moves in Forex happen in tiny fractions, while lots move in large proportions. A definite lot is 100,000 units of the base currency. Usually, traders won’t possess 100,000 Euros or any other currency they’re trading on to invest in every trade. This case is when leverage comes into play. Nearly every forex trade is leveraged.

What Is Leverage In Forex?

The leverage is the Forex broker’s equity to boost the number of trades its customers can make. You deposit a small amount, known as margin. When you finish trading a leveraged position, your gain or loss founds on the trade’s entire volume. This process could either amplify your profits or your loss, including losses that can surpass your margin.

What Is Margin In Forex?

Margin is a crucial aspect of leveraged trading. It is the amount of equity that preserves a leveraged position. However, various Forex brokers offer their traders access to leverage. An average Forex trader doesn’t have the necessary margin to trade at an amount significant enough to make a reasonable profit. Keep in mind that when trading Forex with margin, your margin requirement will alter according to the Forex broker and also the magnitude of your trade.

| Leverage | Amount Traded | Required Margin |

| 1:1 | $100,000 | $100,000 |

| 2:1 | $100,000 | $50,000 |

| 50:1 | $100,000 | $2,000 |

| 100:1 | $100,000 | $1,000 |

| 200:1 | $100,000 | $500 |

| 400:1 | $100,000 | $250 |

Brokers typically illustrate margin as a position of total security. For instance, EUR/GBP might only need 1% of the entire value of the security spent for it to open. So, the trader will deposit $1000 instead of $100,000.

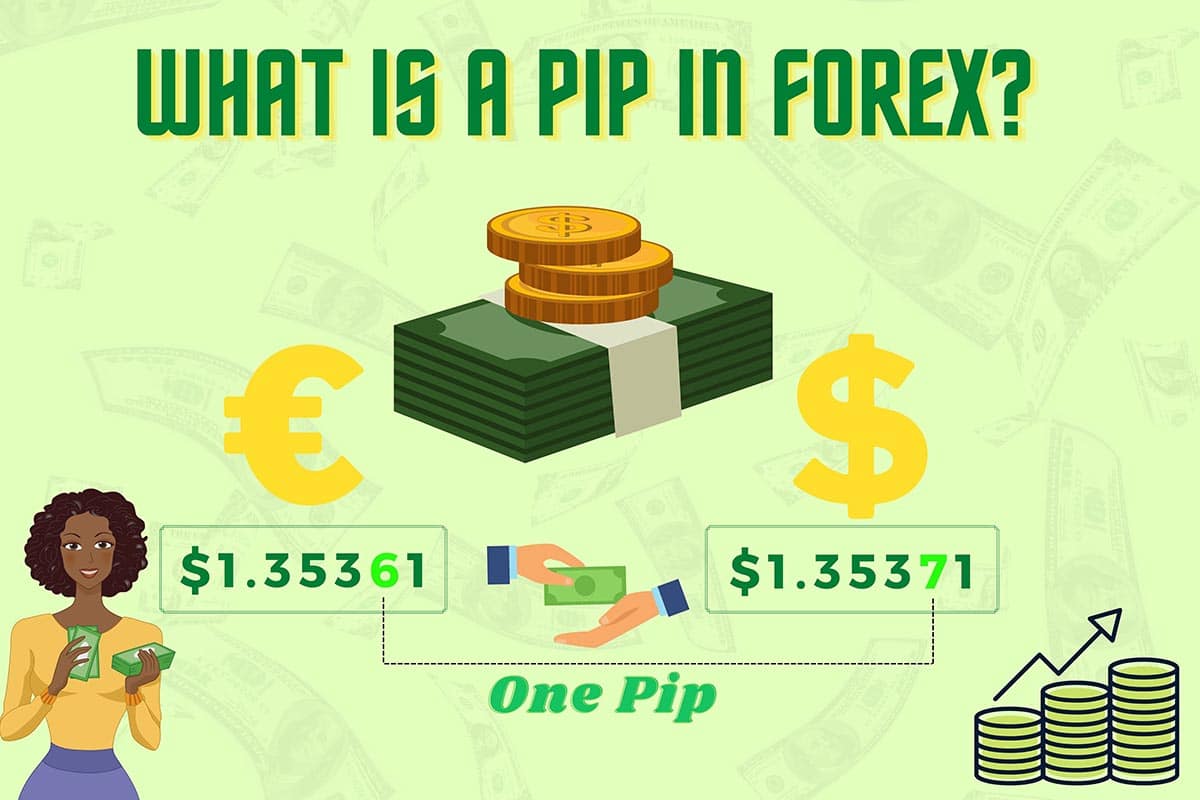

What Is A Pip In Forex?

Pip- percentage in point price used in measuring trends in a forex pair. A forex pip is equal to a one-digit movement in the fourth decimal place of a forex pair. GBP/USD shifts from $1.35361 to $1.35372. The decimal points indicated after the pip referres to as fractional pips, or occasionally pipettes, to move a single pip. But when the quote currency responds in laser denominations, a second decimal place’s movement makes up a single pip. For example, if EUR/JPY moves from ¥106.452 to ¥106.462, it is said to have moved a single pip.

The Bottom Line

These lines are pretty much what foreign exchange is. And now you are probably already involved in foreign exchange trading. Forex trading is the process of exchanging one currency for another. This process is known as buying and selling currency pairs. It founds on the prevailing exchange rate in the Forex market. It happens by exchanging information with a bank or currency broker. Since foreign exchange trading includes exchange rates, it is also about trading in and out of so-called currency pairs that you can trade on a foreign exchange platform such as the London Intercontinental Exchange.

Disclaimer: Please keep in mind that forex trading is risky. A central point is the high leverage, which can bring the trader within seconds in tremendous trouble. You can lose all your money.