This article will examine what payday loans are and how they work and how their payday loan centers are not in your interests. We give you a quick rundown of how payday loans and their centers work. How do lenders work them out? And how they are not in your best interests. You will learn more about how a payday loan works. We also cover how to spot the difference between a credit card loan and a loan from a bank or credit union. We try to figure out how to find a suitable payday loan and get a payday loan if you decide you need one.

How Do Payday Loans Work?

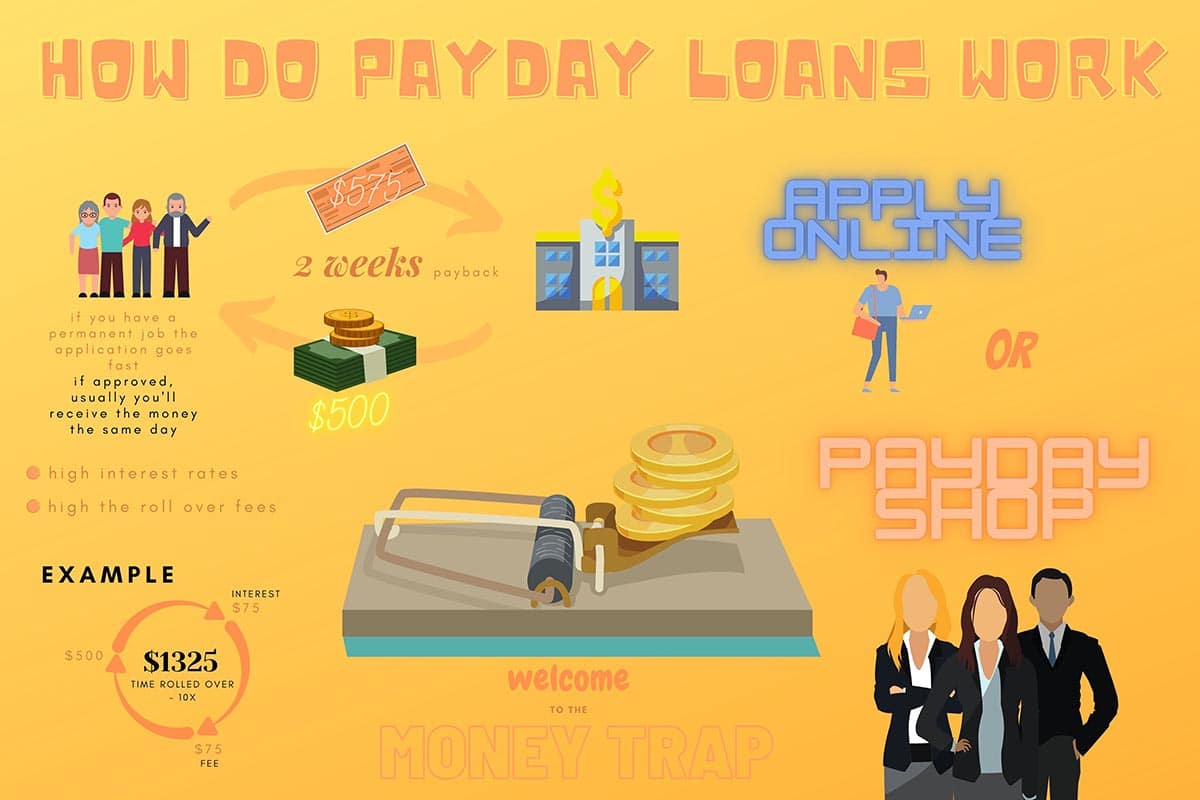

The role of loan credits is outstanding and also other consumer debt. You can also get a paid loan digitally or from a virtual subsidiary with such a financial institution, depends entirely on the venue. Multiple states include various legislation governing payment loans, which restrict the number you will take on the loan or how far the creditor will demand interest payments. So, most countries ban payday loans. You can collect a payment or receipt or make withdrawals into your debit card once you’ve been eligible for just a payday loan. Therefore, you should fully reimburse the mortgage alongside the economic cost, usually in 3 weeks or by the first payout.

The Process Of Payday Loans

Payday loans typically work in the same way. Borrowers have to repay a short-term, high-cost loan within days when they receive their paycheck. They can take the form of a deferred deposit loan, a cheque in advance, or even a passage – a verified loan. People who take out payday loans will often renew their payday loans in states where it is allowed. They do this even though they can’t afford to pay back the loans Payday loans are issued only by payday lenders. They usually pay back the short-term or high cost of the loan only after about a month of repayment.

Why Are Payday Loans Bad?

Payday credits are going to pick you up in a loan process. It might seem that you have no alternative because an incident hits you. And you think you will have bad loans and thus no reserves. However, selecting a payday loan has a detrimental effect on your debt. Any economies you might have or can even force you would go to trial.

The Trap

If you are having trouble paying off a payday loan, lenders may tempt you by payday to apply for extensions known as deferral. These proposals can be a nasty side-effect of credit. The payday loan trap is easier to avoid if you don’t agree to it, the Financial Conduct Authority says.

Payback

If you get a paycheck from a payday loan, you open up access to it by giving the lender permission to garnish your wages. This permission makes it almost impossible for you to move forward. And if you can’t repay your payday loans, lenders can be the most brutal when it comes to collecting.

Payday Loans Are No Personal Loans

Borrowers may need extra money to cover their monthly expenses. Still, at the same time, they are unable to repay a loan on time, leaving them increasingly indebted to the lender that pays on payday. Some lenders even say they won’t lend money to borrowers who have taken out payday loans. Considering that most of them go directly to lenders, these loans are the opposite of quick problem solvers. This fact applies, even if the borrower takes out several paychecks in a year. Payday loans circumvent the law by acting as brokers or mediators between lenders and customers. Unlike a personal loan, a payday loan is not a “personal loan” in the sense that it is a loan from a bank or credit card company.

The Last Chance

Payday loans are expensive and can make your situation worse if you can’t afford to repay them on time. Once again, the only position in which this type of borrowing can make sense for you is if you have no other alternatives at all. In this case, a payday loan is your only way to avoid a severe financial catastrophe and not just delay the inevitable. Before you even consider payday loans, you’ll need to explore other alternatives, as almost all different types of loans are likely to cost less than a paycheck loan.

What Is The Right Situation For A Payday Loan?

If you face an emergency or can’t wait to check in, a payday loan can be a lifesaver. There are alternative credit options that could be healthier than payday loans. If you get one, there’s a much better deal than a paycheck loan. According to the Financial Services Authority, if you need to borrow money to cope with emergencies, personal loans are often a better option for you than payday loans.

How Much Do You Pay Back On A Payday Loan?

Financial institutions usually charge $16-$21 on every $99 or 100 lent. Currently, you can expect 381 percent to 521 percent as an expense in the income statement (APR). This value is almost the same as for credit and debit cards, deposits, personal loans, respectively. Personal loans carry high-interest rates and penalties which mostly make financing quite challenging. If you can’t reimburse a credit for a week’s payment, they send the transaction to a collector who damages your credit.

Do Payday Loans Hurt Your Credit?

The four significant nationwide credit bureaus do not usually disclose paid transactions. So they don’t have an impact on the financial results. You should get these users of the financial card and reduce your creditworthiness if you fail a civil lawsuit involving your mortgage on your paycheck.

Are Payday Loans Easier Or Harder To Payback?

Payday loans are often more rigid than a typical income to cover because a lender has still not verified the repayment until leasing credit. Payday loan companies typically may not analyze your profit debt or reflect the reality of your first debts unless they issue you a mortgage.

Recurring Payments Of How Do Payday Loans Work

A lot of payday creditors would start updating a regular transaction before borrowing the money. It also allows you to use your debit card on your credit note to take whatever you owe checking account. It can also be practical but unpredictable. They won’t leave you with the amount you need for other direct debits on your budget. These guidelines include mortgages or rent, or other essential expenses along with cooking or electricity. And it might react to cash deposits for you through the credit card mark.

Avoiding The Payday Loans Trap

The payday loan company may persuade you only with enhancement such as either a delay or a flip, or maybe an additional loan, whether you have issues reimbursing a payday loan. However, the number of times they may roll over the loan is minimal. The specifics of free debt consulting services are required to be provided with the following information every period. This guideline would sound like an actual suitable response just at a period to roll over your payday loan. And it can create issues immediately because you have to raise so much more in expenses and some other charges.

Alternatives To Payday Loans

People can get into big trouble with credit cards, and while payday loans may seem like a quick fix, other options can help you get out of the cycle of debt. You may not be able to get a traditional bank loan to cover your immediate cash needs, but some companies like Lightstream offer a cheaper alternative to a payday loan. This method of stretching your finances to the next payday may work better than a payday loan.

Find these options than using a payday loan.

- Strengthen a fund in your deposit account. Start building up credit to loan conventional loans

- Maintain strong the case of emergencies cost credit or debit card

- Delete your lenders or credit public sector union’s trademark loan (or emergency fund)

- Collect component jobs for extra revenue

- Coordinate with your creditors a financing plan or mortgage shift

- Evaluate your regular bank credit card insurance-policies

Try for a decent offer of community banking facilities.

If You’re About To Get A Payday Loan

Consider thinking about whether you have to pay back when you take out a personal loan. Would you ever consider whether you’ve been going to have the income initially reward for another month if you’re slow this month? Are you waiting for additional revenue? Or would you still have to reduce expenditure significantly? Take into account if it would be cheaper for all of you to repay a loan in stages. If you choose to receive a whole day of payment loan, confirm that now the amount

What Happens If You Don’t Pay Speedy Cash?

Otherwise, don’t if you can’t afford to pay it back. With mobile emails and phone calls, you can abuse and hold liable. It may also assert that you infringe the Data Protection Act. It may also apply. Both breaches of an Act are due to a minimum of $500, including legal costs for you.

The Bottom Line

· Who wants a deposit which does not have a loan

In these cases, they must supply financing streams and the sum and some other properties and leverage it. Instead of no reimbursement, car titles should use at anywhere.

· Finding better options for emergency loans

Members of the family may also support you in certain situations. Loans for payment are all ok. However, since your loan amount is pretty high, you should also lend such loans and pay them back immediately.

Send your banking stop payment instructions at least three hourly days once bills are due to stop the following expected fee. The order can give in individually, by telephone, or by mail. You will have to submit a stop credit note in correspondence to your account to remove potential transactions. You’ll be sufficient to reimburse your bank loan from your next payday or six months and the day you got the credit.